TORONTO, ONTARIO, May 2, 2023 – NeuPath Health Inc. (TSXV:NPTH), (“NeuPath” or the “Company”), owner and operator of a network of clinics delivering category-leading chronic pain treatment, today announced it has closed its previously announced brokered private placement offering of 10% subordinated and postponed unsecured non-convertible debenture units of the Company (the “Units”) for gross proceeds of $1.453 million (the “Offering”).The Offering was led by Bloom Burton Securities Inc. as lead agent and Hampton Securities Ltd. (collectively, the “Agents”).

1,453 Units were issued pursuant to the Offering. Each Unit is comprised of: (i) $1,000 principal amount of subordinated and postponed unsecured non-convertible debentures of the Company (the “Debentures”); and (ii) for no additional consideration, such number of common shares in the capital of the Company (each whole common share, a “Bonus Share”, and collectively, the “Bonus Shares”) as is equal to 10% of the principal amount of the Debentures purchased divided by $0.09, being the closing market price of the common shares of the Company on the TSX Venture Exchange (the “TSXV”) on April 10, 2023. An aggregate of 1,614,444 Bonus Shares were issued in connection with the closing of the Offering. The Company has used a portion of the proceeds from the Offering to repay the previously announced $0.5 million bridge loan provided to the Company by Bloom Burton & Co. Inc., and will use the balance of the proceeds for corporate and general working capital purposes.

Commenting on the Offering, Joseph Walewicz, the Company’s Chief Executive Officer, noted, “We are pleased to have worked with new and existing shareholders to complete this debt offering, which will solidify our cash resources with modest dilution and assist us in the execution of multiple corporate growth initiatives.”

The Debentures will mature on May 2, 2025 (the “Maturity Date”) and bear interest at a rate of 10% per annum payable quarterly in arrears in cash. The Debentures and the Bonus Shares issued pursuant to the Offering, will be subject to a hold period of four months plus one day from May 2, 2023 (the “Closing Date”).

The Company may redeem the Debentures at any time prior to the Maturity Date in part or in full subject to an early repayment premium equal to: (i) 6% of the principal amount of the Debentures being redeemed if the redemption occurs prior to the date that is six months following the Closing Date; (ii) 5% of such principal amount if redemption occurs following the date that is six months following the Closing Date, but prior to the first anniversary of the Closing Date; (iii) 4% of such principal amount if redemption occurs following the first anniversary of the Closing Date prior to eighteen months following the Closing Date; or (iv) 3% of such principal amount if redemption occurs following eighteen months from the Closing Date, but prior to the Maturity Date.

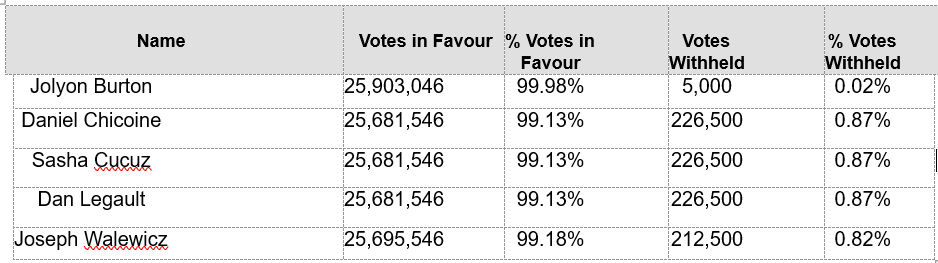

Joseph Walewicz, the Company’s Chief Executive Officer, and Daniel Chicoine, the Company’s Board Chair (collectively, the “Insiders”) participated in the Offering. Such participation is considered a related party transaction within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The related party transaction is exempt from minority approval, information circular, and formal valuation requirements pursuant to the exemptions contained in Sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the gross securities issued nor the consideration paid exceeds 25% of the Company’s market capitalization. The Company did not file a material change report with respect to the participation of the Insiders at least 21 days before the closing of the Offering as the details of the Insiders’ participation in the Offering had not been settled and the Company wished to complete the Offering in an expeditious manner.

As consideration for brokered services provided to the Company in connection with the Offering, the Company paid the Agents, a commission comprised of: (i) a cash fee in the aggregate amount of $75,250; and (ii) an aggregate of 836,111 broker warrants of the Company (“Broker Warrants”). Each Broker Warrant will be exercisable for one common share of the Company at an exercise price equal to $0.15 per common share until May 2, 2025.

About NeuPath

NeuPath operates a network of healthcare clinics and related businesses focused on improved access to care and outcomes for patients by leveraging best-in-class treatments and delivering patient-centered multidisciplinary care. We operate a network of medical clinics in Ontario and Alberta that provide comprehensive assessments and rehabilitation services to clients with chronic pain, musculoskeletal/back injuries, sports related injuries and concussions. In addition, NeuPath provides workplace health services and independent medical assessments to employers and disability insurers through a national network of healthcare providers, as well as contract research services to pharmaceutical and biotechnology companies. NeuPath is focused on enabling each individual we treat to live their best life.

Forward-Looking Statements

This news release contains forward-looking statements. All statements, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation the use of proceeds from the Offering. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations included in this news release include, among other things, the direct and indirect impacts that the COVID-19 pandemic may continue to have on the Company’s operations, adverse market conditions, risks associated with obtaining and maintaining the necessary governmental permits and licenses related to the business of the Company, increasing competition in the market and other risks generally inherent in the chronic pain, sports medicine, concussion and workplace health services markets. A comprehensive discussion of these and other risks and uncertainties can be found in the Company’s annual information form dated March 29, 2023 filed on SEDAR under the Company’s profile at www.sedar.com.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to their inherent uncertainty.

For more information, please contact:

Jeff Zygouras

Chief Financial Officer

info@neupath.com

(905) 858-1368

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS THE RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/